Test of August lows?

Markets broke minor supports last week and heading for testing August lows. Markets may be range bound short term and mostly news driven. Trump Administration is thinking of ways to limit investments into Chinese companies, including stripping Chinese firms from U.S. stock exchanges. Trump Impeachment process started by Democrats in Congress may not be successful for […]

Read MoreHope and Fear!

Markets almost unchanged this week and very close to testing 50 DMA support. FED cut interest rate by quarter point but took away any hope for future cuts for this year but hinted for expanded balance sheet. On Monday Empire State manufacturing showed weakness. Store sales came in little lower than previous period. Manufacturing has […]

Read MoreFED meeting and key reports due!

Markets looking better this week and very close to testing highs. 50 DMA should act as support if this rally has to hold. This week is critical because of FED meeting and announcements on Tuesday and Wednesday. On Monday Empire State manufacturing will be released. Industrial production and Redbook retail results on Tuesday. Wednesday Philadelphia […]

Read MoreTrade talk give hope!

Markets got a big boost this week from news about China Trade talks. Markets overcame major resistance at 50 DMA. Volatility index has come down to 15 indicating market wants to move higher. Leaders are also acting well last two days confirming our sentiments for upside. This market is still news driven and it has […]

Read MoreMarkets at Crossroad!

Markets are range bound with resistance here and support at August 5 lows. Depending on the news it’s moving between these levels. We must watch the test of August 5 lows ahead. Character of the test will determine what should we expect in next coming weeks. Volatility index still high and needs to come down […]

Read MoreTrade War Escalates!

Markets respected resistance level and backed off on Friday. Now we must watch the test of August 5 lows ahead. Character of the test will determine what should we expect in next coming weeks. Volatility index must come down below 15 for market to find legs again. Two major drivers for the market kicked in […]

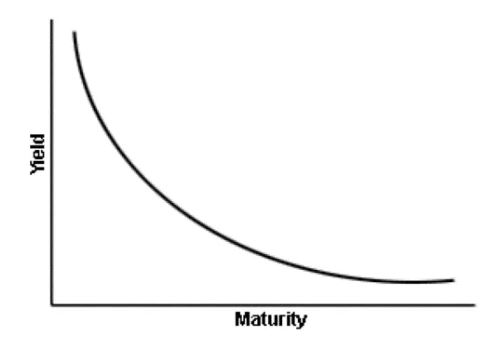

Read MoreYield Curve Inverts

Market showed mixed emotions last week. On Tuesday it made a bold attempt to overcome resistance level but failed miserably on Wednesday. We doubt this rally until it closes above resistance at 50DMA. That is 8000 level for Nasdaq and 2950 for S&P 500. Two major drivers for the market are China Trade talks and […]

Read MoreYuan Devaluation- Financial Earthquake!

Market ended week much better closing near high for the weekly range. It had good three rally and now testing major resistance at 50DMA. That is 8000 level for Nasdaq and 2950 for S&P 500. China trade war is entering new phase. We have seen Currency devaluation by China and possible currency war beginning. US […]

Read MorePositive signs emerge in US-China Talks!!

Market have shown record performance since bottoming in late December. It has overcome important resistances at 50DMA & 200 DMA with ease. Next resistance zone for NASDAQ is 7570-7650 & for SPX zone is 2800-2815. We will not be surprised that market will overcome these zones in next week or so. But one should be […]

Read MoreData driven FED!

All three major indexes charged ahead to new highs. Mixed economic data putting a question mark as to ‘how many rate cuts are ahead?’ Earnings report season is in full swing this week with mixed results. Companies meeting expectations are being rewarded, others are being hammered down. GDP growth is slower than last year indicating […]

Read More