All three major indexes made new highs this week. FED Chairman Mr. Powell’s testimony this week almost promised rate cut end of July and possible two more by end of the year.

Focus now will shift to earnings. Most the analysts are cautious leaving room for positive surprises in coming season.

Leaders are acting well, and some leaders are making new highs and others are breaking out of new bases.

The market is in Uptrend.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Ameritrade Investor Movement Index | 7/8/2019 | June 2019 | 4.93 | 4.61 | ||

| Consumer Credit M/M change | 7/8/2019 | May 2019 | $17.5B | $17.0B | $17.1B | |

| NFIB Small Business Optimism Index | 7/9/2019 | Jun-19 | 105 | 104 | 103.3 | |

| Redbook Store Sales Y/Y Change | 7/9/2019 | WK 7/6, 2019 | 5.5% | 6.2% | ||

| JOLTS Jobs Openings | 7/9/2019 | May 2019 | 7.449M | 7.372M | 7.400M | 7.323M |

| MBA Mortgage Applications W/W Change | 7/10/2019 | WK 7/5, 2019 | -0.1% | -2.4% | ||

| Atlanta Fed Business Infl. Expectations % Yr/Yr | 7/10/2019 | July 2019 | 2.0% | 1.9% | ||

| Wholesale Inventories M/M % change | 7/10/2019 | May 2019 | 0.8% | 0.4% | 0.4% | |

| CPI M/M Change | 7/11/2019 | June 2019 | 0.1% | 0.0% | 0.1% | |

| CPI Y/Y Change | 7/11/2019 | June 2019 | 1.8% | 1.6% | 1.6% | |

| Jobless New Claims | 7/11/2019 | WK 7/6, 2019 | 221K | 222K | 220K | 209K |

| Treasury Budget level | 7/11/2019 | June 2019 | $207.8B | -8.5B | ||

| FED Balance Sheet | 7/11/2019 | WK 7/10, 2019 | $3.813T | $3.815T | ||

| Money Supply Weekly Change | 7/11/2019 | WK 7/1, 2019 | $19.5B | $20.5B | $46.0B | |

| PPI FD M/M Change | 7/12/2019 | June 2019 | 0.1% | 0.1% | 0.1% | |

| PPI FD Y/Y Change | 7/12/2019 | June 2020 | 1.8% | 1.7% | 1.7% | |

| Baker-Hughes Rig Count | 7/12/2019 | WK 7/12, 2019 | 1083 | 1075 |

This week’s major events:

| Monday | Empire State Mfg. Survey | ||

| Tuesday | Retail Sales; Import and Export Prices; Redbook; Industrial Production; Business Inventories; Housing Market Index; Treasury International Capital | ||

| Wednesday | MBA Mortgage Applications; Housing Starts; Beige Book | ||

| Thursday | Jobless Claims; Philadelphia FED Business Outlook; Leading Indicators; FED Balance Sheet; Money Supply | ||

| Friday | Consumer Sentiment; Baker-Hughes Rig Count | ||

Economy:

US Economy is solid. Job engine is doing fine but major worry for FED is inflation numbers. Year over year it’s 1.6%, way below 2% target. This week, Jerome Powell highlighted slower business investment and low inflation as the two main justifications for “somewhat more accommodative monetary policy.”

“We see the risk of prolonged shortfall” of inflation from Fed’s 2% target, he said.

Fed chief indicated his concerns about trade uncertainties as we pointed in our reports earlier. “It appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook.”

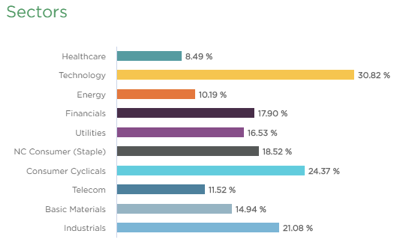

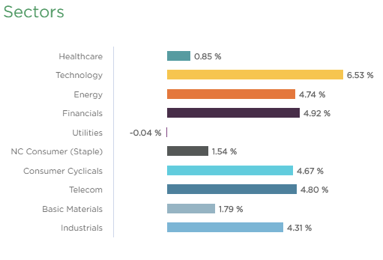

Sector performance:

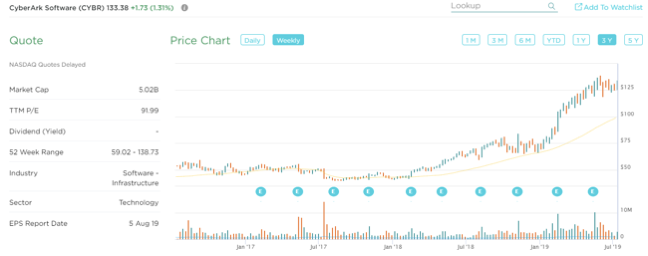

Stock to Watch: Cyber Ark Software (CYBR)

Cyber Ark software provides information technology security solutions to protect data, infrastructure and assets across the enterprise. Its products and services include Enterprise Password Vault, Privileged Session Manager, Privileged Threat Analytics, Cyber ark Privilege Cloud. Geographically, it generates maximum revenue from the United States and has a presence in EMEA and Rest of World.

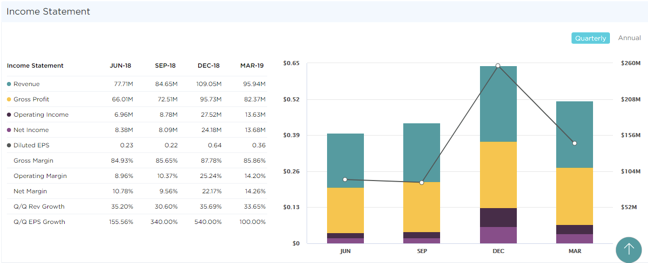

CYBR has been growing over 30% annually. Last few quarters sales growth has been fantastic 35%; 30%; 36%; 34% with EPS growth of 155%; 340%; 540%; 100%. Annual EPS in 2016 of $0.78 has grown to $1.45 in TTM. Estimated EPS growth for next two years is 18%. It has seen growth in equity steadily for past four years. Net margins have been in mid-eighties and ROE of 19%. Management owns 38% of shares outstanding. Institutional owners have increased from 227 to 411 in past four quarters showing confidence.

CYBR has been the leader in industry holding number one spot. It has been leader also in current cycle with strong relative strength gaining over 100% within five months. It is an ideal time to add/buy CYBR as it tries to break out of flat base of price consolidation of 7 weeks.

Strongest groups are Energy, Software, Insurance, Business service, Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Retail, Food, Auto, Media, Medical

Watch List: Our strong RS/Growth screen is showing following candidates.

TEAM, CHGG, PYPL, CYBR, FIVN, SHOP, LLY, LULU, NOW, HUBS, FIVE, ADBE, ADSK, MSFT, HEIA, TWLO, WDAY, ETSY, EPAM, MTCH, LPLA, GDDY; AMZN, PAGS, FB, FNKO, BAH, CPRT, ENTH, HEI, LLL, PAYC, PGR, PODD, VEEV, VRSN, KL, GNRC, CACC, AMD, MDSO, BZUN

Summary:

Major indexes are making new highs. With green light from FED, focus now turns to earning season. Look out for strong RS stocks and add early leaders or new ones that are emerging here.