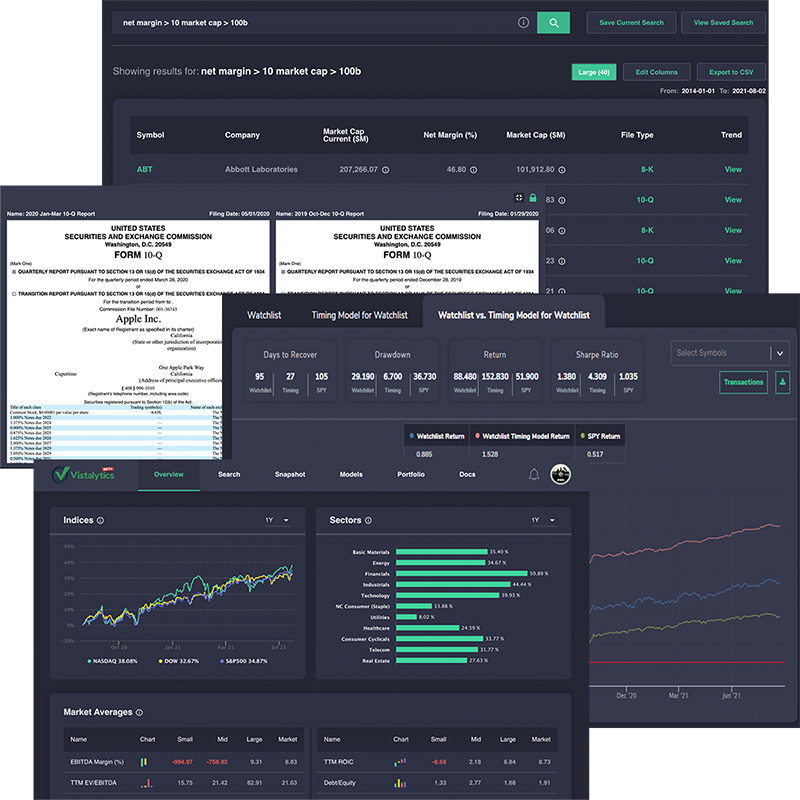

Deeper Analytics

Vistalytics' analytics engine monitors all underlying data and documents for hundreds of securities to discover, parse, and alert on material changes in near real-time.

Better Performance

Vistalytics' trained Machine Learning Model monitors all underlying options activity across hundreds of assets to accurately predict price direction in near real-time.

Proven Team

The Vistalytics team has over a century of combined experience, that has gone into creating a revolutionary new way to approach hedge fund portfolio management.