Markets seem to have found support last week at previous resistance levels.

There are few pockets showing positive action. In concert with our short-term composite model turning negative this past week, weaker global markets have continued to decline. VEU, EEM, and EFA all moved lower and are testing critical support levels from their August lows here – and new lows in these could lead to broader spillover damage for the US and other markets as we’ve been warning about for weeks here.

While the breadth of global markets moving lower last week was substantial, the weaker sisters we’ve been watching have remained downside leaders. Last week we got new lows in RSX, IDX, ARGT, and EZA – and if new lows among the weak sisters continues to expand, this is likely to increasingly pull other markets down in spillover action.

Recap of last week:

President Trump threatened to up the tariff ante on China to essentially everything they export to the U.S. Business magazine Fortune reported that Trump also was hinting at slapping Japan with tariffs.

The US economy remains very robust, despite animosities caused by tariffs and Trump’s overall adversarial style. No matter how you feel politically or emotionally about our president, fact is that we are growing jobs faster than expected. The monthly Labor Department jobs report for August showed another 201,000 net new jobs created in August while wage growth was very high at a 2.9% annual growth rate. This large of an increase in wages has elevated expectations of more interest-rate hikes. The 10-year Treasury yield popped seven basis points to 2.94%.

The CME FedWatch Tool puts the likelihood of a Federal Reserve rate hike later this month at 99.8%. For December, the likelihood of an additional hike — after the presumed September hike — is set at 77.6%.

Q2 earnings season is mostly over and it went well. Yet, while individual stocks had their fair share of price gains on beats, this didn’t seem to help the indexes.

Coming back to tariffs: Generally, until Trump came to office, it has been a uneven playing field regarding tariffs and US industry has been disadvantaged. China has been able in the past to get away with intellectual property theft and If you look at EU and Canada’s tariffs, particularly for agricultural products, along with the EU’s stringent regulations for imported food, it has certainly been an uneven playing field. So in that sense, Trump’s bullying, threatening style has likely had a positive impact for our industry. At the same time, things are not black or white when it comes to international trade.

This week’s major events:

- On Wednesday, few FED members speak. Pay attention to language about recent wage report and interest rate changes in near future. Markets reaction to them is important to understand.

- On Thursday, we have CPI and Jobless claims numbers.

- On Friday, report on Retail sales and Industrial production numbers are released.

Strongest groups are 1) Retail 2) Medical-software 3) Medical- products 4) Medical-Hospitals 5) Enterprise-Software

Weakest groups are 1) Steel 2) Machinery 3) Building (residential, Commercial) 4) Solar -energy 5) Chemical

Sector performance in recent three months:

Chart 1. 3M performance of Sectors. Courtesy Vistalitics.COM

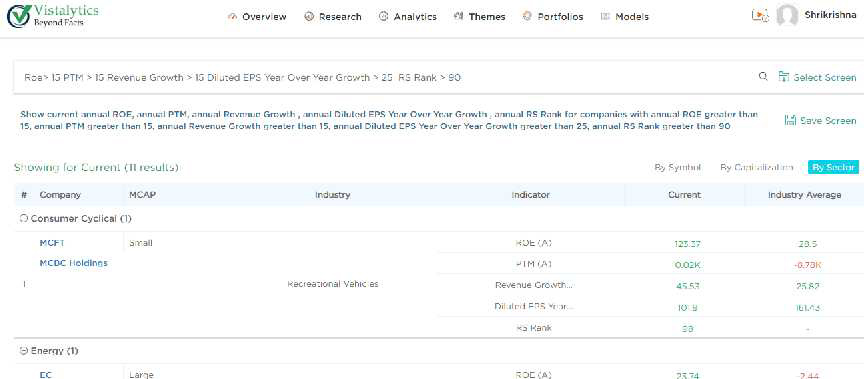

Our strong RS/Growth screen narrowed lists of potential candidates to put on “Watch list”

Some of them are EC, SIVB, RAVN, ADBE, HQY, NVDIA, VEEV

Chart 2 Watch list Courtesy Vistalitics.Com

In summary, techs, Healthcare, small-cap growth, Defense, and Consumer Cyclicals appear to offer the best opportunities for new buying, although further downside below June-July lows would lead us to suggest further caution for now.

Look to add more long stock exposure in newer upside leaders and look for other positions as good reward/risk opportunities open up ahead as we get new signals and when our shorter-term models align better with intermediate and longer-term uptrends ahead. Stay nimble and alert as opportunities could proliferate ahead!