Markets have reacted further with selling pressure this past week. It has been the worst week for markets since 2008 financial crisis. We are officially in ‘Bear’ territory on NASDAQ and SPX at 2350. FED chairman Mr. Powell has gotten what he wanted before he turns dovish. In September speech he indicated that ‘market moves’ are of no concern to FED unless substantial correction to change its course on interest rate hikes and QT (Quantitative Tightening). Markets are also concerned about our President Trump. His decisions on pulling out of Syria without any consultations with Generals (Secretary of Defense resigns) & his headstrong approach for ‘building Wall’ at expense of Government shutdown are being read by the market as feeling cornered and reacting to do anything to pacify his base. Wall Street fears of wounded Trump. It is creating uncertainty which market hates. We are at 36 on VIX as of today. This is where we could find potential support. Let us watch if Mr. Trump allows market to find bottom here.

Markets will give us solid signal of demand coming back and new bull market has started. Until then it is in our interest hold cash

position.

World markets have also broken prior lows here. This is another indication that global economies will have soft spot in near future.

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Empire State Mfg Survey | 12/17/2018 | Dec-18 | 23.30 | 21.00 | 10.90 |

Recap of last week:

US Tariffs: There is a silver lining to FED’s rate hike, there is more likelihood that Trump will be inclined to have a China Deal. But this will more likely amount to cease-fire, not a truce. Justice Department’s charges against Chinese Intelligence officers’ involvement in campaign to hack and steal secrets from technology companies and government. China cannot afford Cold Technology War with US. They are too dependent on American technology companies. Only reason, deal will not happen is if Mr. Trump asks too much that will essentially mean China to bow down to US. With Mr. Trump that’s quite possible. Another worry for markets to deal with!

Economic Reports:

| Housing Market Index | 12/17/2018 | Dec-18 | 60.00 | 61.00 | 56.00 | |

| Housing Starts | 12/18/2018 | Nov-18 | 1228M | 1217M | 1221M | 1256M |

| Existing Home sells | 12/19/2018 | Nov-18 | 5.220M | 5.19M | 5.32M | |

| FOMC Meeting Announcement | 12/19/2018 | 2.00 – 2.25% | 2.38% | 2.25- 2.50% | ||

| Jobless Claims | 12/20/2018 | Wk 1215 | 206K | 220K | 214K | |

| Philly FED Business Outlook | 12/20/2018 | Dec-18 | 12.9 | 16.5 | 9.4 | |

| Leading Indicators | 12/20/2018 | Nov-18 | 0.1% | -0.3% | 0.0 | 0.2% |

| Durable Goods Orders (new orders) M/M change | 12/21/2018 | Nov-18 | -4.4% | -4.3% | 1.4% | 0.8% |

| Real GDP Q/Q change | 12/21/2018 | Q3-2018 | 3.50% | 3.50% | 3.40% | |

| Consumer Sentiment | 12/21/2018 | Dec-18 | 97.5 | 97.5 | 98.3 | |

| Personal Income M/M change | 12/21/2018 | Nov-18 | 0.5% | 0.3% | 0.2% | |

| Consumer Spending M/M change | 12/21/2018 | Nov-18 | 0.6% | 0.8% | 0.3% | 0.4% |

Empire State Mfg Survey & Philly Fed both declined more than consensus indicating forthcoming weakness in economy. Consumer sentiment stayed high along with consumer spending. Is the consumer living on borrowed time?

This week’s major events:

| Monday | None |

| Tuesday | Holiday |

| Wednesday | Case Shiller Housing Price Index |

| Thursday | Jobless Claims; New Home Sales; Consumer Confidence |

| Friday | International Trade; Chicago PMI; Pending Home Sales |

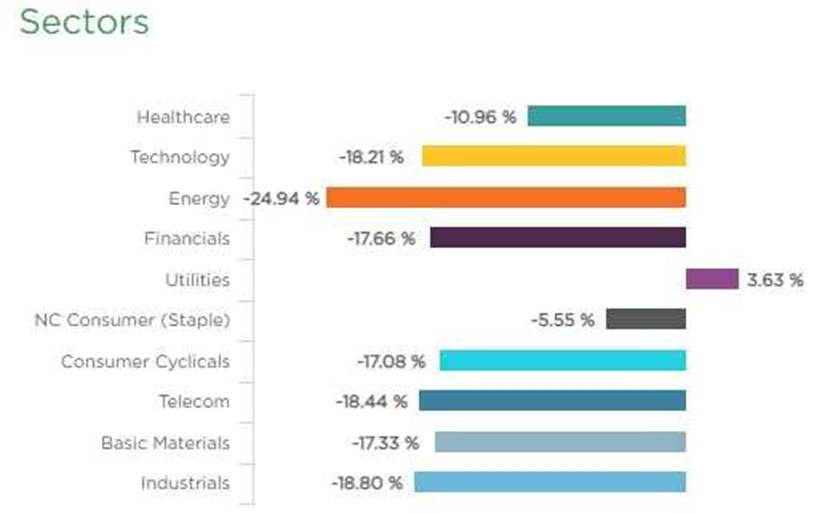

Sector performance in last 3 month ending December 20, 2018:

Chart 1. Three Months performance of Sectors. Courtesy www.Vistalytics.COM This one is a clear picture of extent of damage in all sectors past three months except Utilities (defensive sector).

Strongest groups are Utilities, Auto Parts & Healthcare (Medical-Outpatient)

Weakest groups are Basic Materials, Energy & Steel.

Watch List: Our strong RS/Growth screen turned up no potential candidates to put on “Watch list”. It tells you how bad the market has been this past week.

Summary: US & global markets have broken February lows and in ‘Bear’ territory. Sentiments are getting too bearish and we could see some sort of bottom close by. In falling knife scenario and in Trump era, close by may not be so close. Wait for clear signal of demand coming in before venturing into market.