All indexes have trading above 200 DMA but prior resistance zones near here need to be overcome. So far market is handling it ok with end of the day rallies from lows. The market is in confirmed rally. Volatility index VIX has tested breakout of support level 16. This is encouraging for bulls. Earnings reports have been somewhat volatile. Earning season has shown more positive results than negative surprises so far.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Redbook Store Sales Y/Y Vhange | 2/12/2019 | Wk 2/9 | 5.7% | 4.7% | ||

| JOLTS Job Openings | 2/12/2019 | Dec-18 | 6.888M | 7.116M | 6.90M | 7.335M |

| CPI M/M Change | 2/13/2019 | Jan-19 | -0.1% | 0.0% | 0.1% | 0.0% |

| CPI less food & energy M/M Change | 2/13/2019 | Jan-19 | 0.2% | 0.2% | 0.2% | |

| Jobless Claims | 2/14/2019 | Q4:2018 | -1.1% | 1.0% | 0.1% | |

| PPI-FD | 2/14/2019 | Q4:2018 | 3.9% | 4.0% | 4.3% | |

| Retail sales | 2/14/2019 | wk2/2 2019 | 223k | 223k | 234k | |

| Business Inventories | 2/14/2019 | wk2/6 2019 | $4.40T | $4.026T | ||

| Empire State Mfg Survey | 2/15/2019 | Feb-19 | 3.9 | 7.6 | 8.8 | |

| Industrial Production M/M Change | 2/15/2019 | Jan-19 | 0.3% | 0.1% | 0.1% | -0.6% |

| Consumer Sentiment | 2/15/2019 | Feb-19 | 91.2 | 93.0 | 95.5 |

This week’s major events:

| Monday | Holiday |

| Tuesday | Housing Market Index |

| Wednesday | Redbook; E-Commerce Retail Sales, FOMC Minutes |

| Thursday | Durable Goods Order; Jobless Claims; Philly FED Survey; Existing Home Sales; Leading Indicators; FED Balance sheet |

| Friday | Baker Hughes Rig Count |

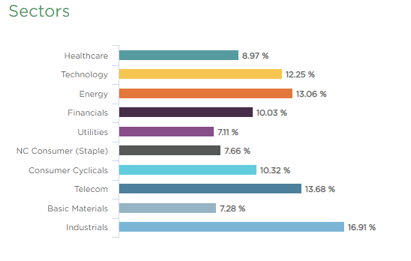

Sector performance YTD ending Feb 15, 2019:

Stock to Watch: Incyte Corporation

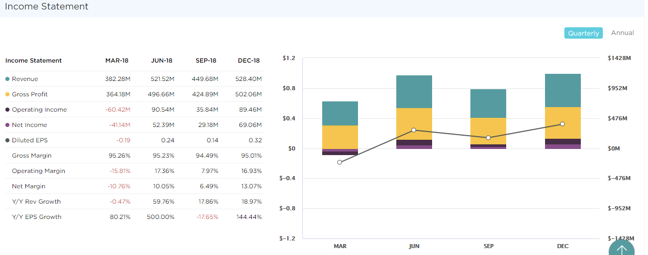

This week we highlight Incyte Corporation (INCY). Biotech company develops small molecule drugs that treat cancer and inflammatory diseases. It has an outstanding annual growth rate of 105%. Return on Equity is 13%. Its Gross Margins are 95%. Net Margins have expanded steadily from 6% to 13%. In past few quarters, EPS has been in triple digits (100%; 999%) with Sales growth for past four quarters (0%; 50%; 18%; 19%). Next Qtr EPS est is 1400%. This year 2019 EPS estimates are indicating growth of 88%. Insider buyers have been buying in last six months. Management owns 17% of company. This is undervalued and has potential to double in next 18 months.

In recent market correction, stock had held up well and showing strength in last 10 weeks. Stock is a buy in low 80s.

Strongest groups are Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Oil& Gas Exploration & production, Transportation & Steel.

Watch List: Our strong RS/Growth screen is showing following candidates. List is expanding this week. TEAM, CHGG, FN, PYPL, CYBR, BEAT, VRTX, FIVN, CASY, LLY, LULU, NOW, SAVE, HUBS, BA, FIVE, ADBE, MLNX, INCY, ABMD, PANW

Summary:

Markets are consolidating resistance zone. More leaders are participating in the rally. It’s ok to add exposure to strong groups.