Small caps overcame major resistance level on strong job report and lowest unemployment rate since 1969. Nasdaq closed on NH. Midweek NASDAQ and S&P got support at 21DMA and Friday’s economic reports put the sizzle into small-cap index Russell 2000. Overnight markets were off over 2% on President Trump’s remarks on increasing tariffs on Chinese goods. We must watch how markets react tomorrow. If they bounce back, then markets are looking for NH in next month or so. If not, look for some consolidation near term.

A strong economy with accommodative FED and progress in trade talks with China is setting a stage for a new Bull market.

The market is in ‘Confirmed Uptrend’. Our models are positive for intermediate & long trend.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Personal Income M/M Change | 4/29/2019 | Feb 2019 | -0.1% | 0.3% | 0.2% | |

| Consumer Spending M/M Change | 4/29/2019 | Feb 2019 | 0.1% | 0.3% | 0.3% | 0.1% |

| Richmond Fed Activity Index | 4/29/2019 | April 2019 | 8.3 | 6.9 | 9.8 | 2.00 |

| Employment Cost Index Q/Q change | 4/30/2019 | Q 1:2019 | 0.7% | 0.7% | 0.7% | |

| Redbook Store Sales Y/Y Change | 4/30/2019 | WK 4/27, 2019 | 6.0% | 5.5% | ||

| Case Shiller HPI | 4/30/2019 | Feb 2019 | 01% | 0.3% | 0.2% | |

| Chicago PMI | 4/30/2019 | April 2019 | 58.7 | 59 | 52.6 | |

| Consumer Confidence | 4/30/2019 | April 2019 | 124.1 | 124.2 | 127.1 | 129.2 |

| Pending Home Sales | 4/30/2019 | March 2019 | -1.0% | 0.7% | 3.8% | |

| MBA Mortgage Applications W/W Change | 5/1/2019 | WK 4/26, 2019 | -7.3% | -4.3% | ||

| ADP Employment Report | 5/1/2019 | April 2019 | 129,000 | 151,000 | 180,000 | 275,000 |

| PMI Mfg Index | 5/1/2019 | April 2019 | 52.4 | 52.4 | 52.6 | |

| ISM Mfg Index | 5/1/2019 | April 2019 | 55.3 | 55 | 52.8 | |

| Construction spending M/M Change | 5/1/2019 | March 2019 | 1.0% | 0.7% | 0.2% | -0.9% |

| Total Vehicle Sales | 5/2/2019 | April 2019 | 17.5M | 17.0M | 16.4M | |

| Challenger Job cut Report | 5/2/2019 | April 2019 | 60,587 | 40,023 | ||

| Jobless New Claims | 5/2/2019 | WK 4/27, 2019 | 230K | 215K | 230K | |

| Non-farm Productivity Q/Q change | 5/2/2019 | Q1:2019 | 1.9% | 1.3% | 1.9% | 3.6% |

| Unit Labor Costs Q/Q Change | 5/2/2019 | Q1:2019 | 2.0% | 2.5% | 1.8% | -0.9% |

| Factory Orders M/M Change | 5/2/2019 | March 2019 | -0.5% | -0.3% | 1.5% | 1.9% |

| Non-farm Payrolls M/M change | 5/3/2019 | April 2019 | 196,000 | 189,000 | 180,000 | 263,000 |

| Unemployment Rate | 5/3/2019 | April 2019 | 3.8% | 3.8% | 3.6% | |

| Private Payrolls M/M Change | 5/3/2019 | April 2019 | 182,000 | 179,000 | 178,000 | 236,000 |

| PMI Services Index | 5/3/2019 | April 2019 | 55.3 | 52.9 | 53 | |

| ISM Mfg Index | 5/3/2019 | April 2019 | 56.1 | 57.3 | 55.5 | |

| Baker-Hughes Rig Count | 5/3/2019 | Wk 5/03; 2019 | 1054 | 1051 |

This week’s major events:

| Monday | |||

| Tuesday | Redbook; JOLTS; Consumer Credit | ||

| Wednesday | MBA Mortgage Applications | ||

| Thursday | International Trade; Jobless Claims; PPI-FD; Wholesale Trade | ||

| Friday | CPI; Baker-Hughes Rig count |

Economy:

No-farm payrolls increased by 263,000, 46% more than expected. The unemployment rate dropped to 3.6%, the lowest level going back to October 1969. FED left interest rates unchanged as anticipated. Productivity rose 2.7% from a year ago in the first quarter, the biggest jump since 2010.

The reports confirm the enviable situation the US economy is in right now.

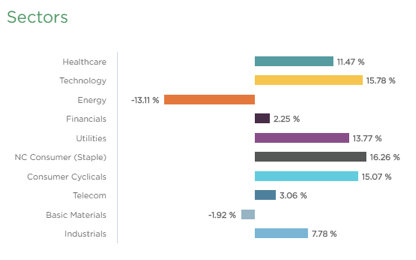

Sector performance YTD performance ending May 03, 2019:

Stock to Watch: Facebook (FB)

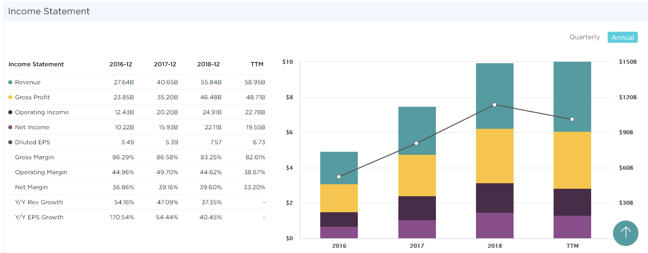

FB provides a platform enabling members to stay connected with friends and family. FB has faced regulatory headwinds since the 2016 elections. Management has managed this short-term problem nicely with very little effect on its revenue base or margins. Its unique position enables it to see further price appreciation ahead.

Facebook has been growing 72% annually. Last few quarters sales growth has been 33%; 30%; 26% with EPS growth of 11%; 8%; 12%. Annual EPS in 2015 of $1.29 has grown to $7.57 in 2018. The estimated EPS growth for the next two years is 30%. Gross margins have been maintained in 83% and ROE of 28%. Management owns 1% of shares outstanding.

Strongest groups are Energy, Chips, Software, Finance, Business service, Insurance, Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Retail; Media; Medical; Food.

Watch List: Our strong RS/Growth screen is showing following candidates. List is expanding this week.

TEAM, CHGG, FN, PYPL, CYBR, BEAT, VRTX, FIVN, CASY, LLY, LULU, NOW, SAVE, HUBS, BA, FIVE, ADBE, INCY, ABMD, PANW, ADSK, MSFT, HEIA, UBNT, TWLO, TTD, WDAY, ETSY, EPAM, ANET, MTCH, LPLA, FTNT, GDDY; AMZN, PAGS, ATHM, TWLO, BZUN, ALXN, FB

Summary:

Markets are near all-time high of September 2018 last week. We expect some sideways action to continue near term.