Market encountered resistance zone for NASDAQ is 7570-7650 & for SPX zone is 2800-2815 last week. We saw markets giving back 200DMA support and we were cautiously watching for 50DMA support for trigger. Market charged on today with sharp rally and closing once again above 200DMA. This is how strong bull market behave. This is particularly important to note considering the backdrop of Boing airplane crash in Ethiopia killing 157 affecting Boing shares and Brexit deadline getting close without any deal. The market is in confirmed rally. Our models are positive for intermediate & long trend. We are little cautious on short-term trend. Most of the investors should be focused on intermediate term and long-term trends. Stay focused on strong holdings and opportunity to add to them. Leaders will continue to be leaders in coming months. That’s where most of the money will be made.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Motor Vehicle Sales | 3/4/2019 | Feb-19 | 16.6M | 16.7M | 16.9M | 16.5M |

| Construction Spending M/M Change | 3/4/2019 | Dec-18 | 0.8% | 0.3% | -0.6% | |

| Store Sales Y/Y Change | 3/5/2019 | Wk3/2, 2019 | 5.2% | 4.2% | ||

| New Home Sales | 3/5/2019 | Dec-18 | 657K | 599K | 590K | 621K |

| ISM Non-Mfg Index | 3/5/2019 | Feb-19 | ‘56.7 | 57.2 | 59.7 | |

| Challenger Job Cut Report | 3/7/2019 | Feb-19 | 52,988 | 76,835 | ||

| Jobless Claims | 3/7/2019 | Wk3/2, 2019 | 225K | 226K | 220K | 223K |

| Nonfarm Productivity Q/Q Change | 3/7/2019 | Q-4:2018 | 1.6% | 1.9% | ||

| Unit Labor Costs Q/Q change | 3/7/2019 | Q-4:2018 | 1.8% | 2.0% | ||

| Nonfarm Payrolls M/M change | 3/8/2019 | Feb-19 | 304,000 | 311,000 | 175,000 | 20,000 |

| Unemployment Rate | 3/8/2019 | Feb-19 | 4% | 3.9% | 3.8% | |

| Housing Starts | 3/8/2019 | Jan-19 | 1078M | 1037M | 1170M | 1230M |

| Baker-Hughes Rig Count | 3/8/2019 | Wk 3/8 2019 | 1249 | 1216 |

This week’s major events:

| Monday | Retail Sales; Business Inventories |

| Tuesday | Small Business Optimism Index; CPI; Redbook |

| Wednesday | Mortgage Applications; PPI-FD; Construction Spending |

| Thursday | Jobless Claims; Import & Export Prices; New Home Sales |

| Friday | Empire State Mfg Survey; Industrial Production; Consumer Sentiment; JOLTS; Baker-Hughes Rig Count |

Economy:

Last week’s jobs report was yellow flag for the economy. New jobs added were only 20,000 far less than expected number of 178,000. Unemployment remains strong at 3.8% and wage growth of 4%.

ECB will keep 0% interest rates until at least the end of the year, as ECB boss Mario Draghi had reduced growth expectations for the EU. Germany is facing slower industrial growth, as established players (steel, car makers) are facing the age of digitalization and electrification (cars), and have to retool.

China has dialed back its economic growth projections while also ordering its banks to issue more loans to businesses. Exports for January were 21% lower than last year and exports pulled back 5%. The OECD also lowered its outlook for global growth. Speaking of Europe: Tuesday is shaping up to be a very big day for England, as the UK parliament is basically deciding if the UK will leave the EU in an orderly fashion.

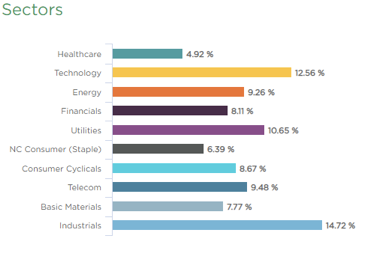

Sector performance YTD ending March 09, 2019:

Stock to Watch: The Trade Desk Inc.

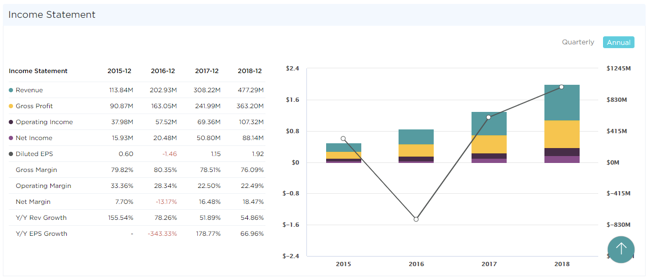

This week’s pick is The Trade Desk Inc. (TTD). Company provides self-service platform used by buyer to provide data-driven digital advertising. It has an impressive annual growth rate of 69%. Return on Equity is 38%. Its Gross Margins are 76%. Net Margins have expanded steadily from 18%. In past few quarters, EPS has been growing (91%; 124%) with annual Sales growth for past few years (78%; 51%; 55%). Next year 2020 EPS estimates are indicating growth of 24%. Fund ownership has increased from 280 in March 18 to current level of 450. This is a good play in advertising technology with potential price appreciation in next two years.

Strongest groups are Energy, Software, Insurance, Mining, Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Retail; Food.

Watch List: Our strong RS/Growth screen is showing following candidates. List is expanding this week.

TEAM, CHGG, FN, PYPL, CYBR, BEAT, VRTX, FIVN, CASY, LLY, LULU, NOW, SAVE, HUBS, BA, FIVE, ADBE, INCY, ABMD, PANW, SSNC, ADBE, ADSK, MSFT, HEIA, UBNT, TWLO, TTD, WDAY, ETSY, EPAM. This week our pick ‘MLNX’ was acquired by Nvidia with 18% appreciation in four weeks after our recommendation here.

Summary:

Markets are reacting from resistance zone in normal fashion. Look for support near 50DMA on indexes and participate in strong stocks going forward. Vistalytics platform is very versatile and allows you to see strong sectors and sector leaders fast in current market environment.