Market is still close to last year highs. It barely moved (-0.25%) in last week. Mueller report came out with no ‘surprises’. Market yawned while Washington is trying to make sense of the report. US economic news remain positive with retail gaining steam and job reports remain strong.

The market is in ‘Confirmed Up trend’. Our models are positive for intermediate & long trend. Short-term markets seem to be resting except some sector rotations. Healthcare sector got whacked (-5.0%) on “Burnie Sanders” comments in FOX town hall meeting.

Earnings season is gaining momentum.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Empire State Mfg- Business Conditions | 4/15/2019 | Apr 19 | 3.7 | 6.8 | 10.1 | |

| Redbook Store Sales Y/Y Change | 4/16/2019 | WK 4/13, 2019 | 4.8% | 5.0% | ||

| Industrial Production Capacity Utilization | 4/16/2019 | March 19 | 78.2% | 79.0% | 79.1% | 78.8% |

| Housing Market Index | 4/16/2019 | Apr 2019 | 62 | 63 | 63 | |

| MBA Mortgage Applications W/W Change | 4/17/2019 | WK 4/12, 2019 | -5.6% | -3.5% | ||

| US Wholesale Trade Inventories M/M Change | 4/17/2019 | Feb 19 | 1.2% | 0.3% | 0.2% | |

| US International Trade Trade Balance Level | 4/17/2019 | Feb 20 | $-51.1B | $-53.6B | $-49.4B | |

| Jobless New Claims | 4/18/2019 | WK 4/13, 2019 | 196K | 197K | 206K | 192K |

| Retail Sales M/M Change | 4/18/2019 | March 19 | -0.2% | 0.8% | 1.6% | |

| PMI Composite Flash | 4/18/2019 | April 19 | 54.3 | 54.3 | 52.8 | |

| Business Inventories M/M Change | 4/18/2019 | Feb 19 | 0.8% | 0.9% | 0.3% | 0.3% |

| Leading Indicators | 4/18/2019 | March 19 | 0.2% | 0.1% | 0.3% | 04% |

| Baker-Hughes Rig Count | 4/18/2019 | Wk 4/19; 2019 | 1088 | 1078 | ||

| US Housing Starts | 4/19/2019 | March 19 | 1.162M | 1.142M | 1.230M | 1.139M |

This week’s major events:

| Monday | Chicago Fed National Activity; Existing Home Sales |

| Tuesday | Redbook; New Home Sales; House Price Index; Richmond Fed Mfg |

| Wednesday | MBA Mortgage Applications; State Street Investor Confidence Index |

| Thursday | Jobless Claims; Durable Goods Orders; Kansas City Fed Mfg Index |

| Friday | GDP; Consumer Sentiment; Baker-Hughes Rig count |

Economy:

Jobs reports continue to be positive and lowest in 50 years. Retail sales are much stronger than anticipated at 1.6% annual growth vs 0.8% expected. Capacity utilization is at 78.8%, way below to cause inflationary pressure. Housing starts still lagging. Overall healthy economic reports.

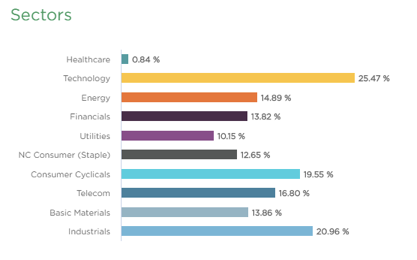

Sector performance YTD performance ending April 19, 2019:

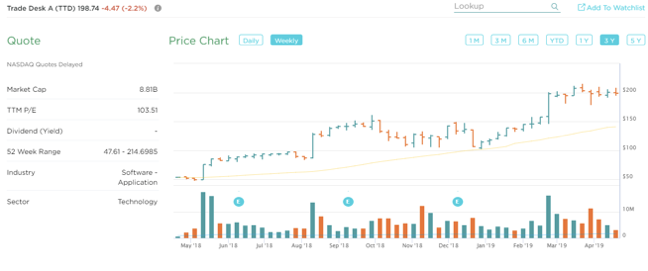

Stock to Watch: Trade Desk (TTD)

The Trade Desk Inc. is in Software industry. It provides Self-Service platform for Ad-buyers.

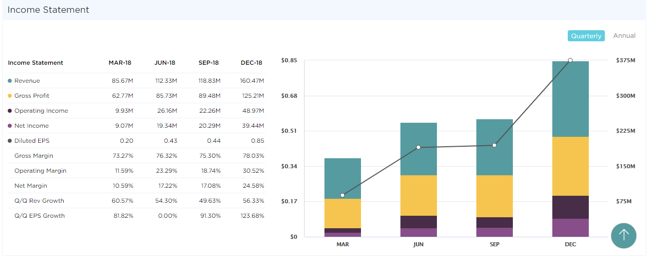

The Trade Desk has been growing 69% annually. Last few quarters sales growth has been 54%; 50%; 56% with EPS growth of 15%; 85%; 102%. Annual EPS in 2015 of $0.56 has grown to $2.70 in 2018. Estimated EPS growth for next two years is 29%. Gross margins have stayed in 75% to 80% range and ROE of 39%. Management owns 3% of shares outstanding.

It is an ideal time to buy TTD as it forms a flag close to 50DMA. It could have nice price appreciation with low risk entry point.

Strongest groups are Software, Finance, Chips, Energy, Insurance, Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Transport; Retail; Medical; Food.

Watch List: Our strong RS/Growth screen is showing following candidates. List is expanding this week.

TEAM, CHGG, FN, PYPL, CYBR, BEAT, VRTX, FIVN, CASY, LLY, LULU, NOW, SAVE, HUBS, BA, FIVE, ADBE, INCY, ABMD, PANW, SSNC, ADSK, MSFT, HEIA, UBNT, TWLO, TTD, WDAY, ETSY, EPAM, ANET, MTCH, LPLA, FTNT, GDDY; AMZN, PAGS, ATHM

Summary:

Markets are almost unchanged from last week. We expect some sideways action to continue near term. Sector rotations is in play.