The stock market is trying to overcome resistance near 8250 level for NASDAQ and 3030 on SP500. Support level at 8000 held well.

Market is responding positively to news.

FED meeting this week can tilt the market one way or the other. UK Parliament voted ‘yes’ for BREXIT deal but “no’ on timeline. This could force election in UK.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Store Sales Y/Y Change | 10/22/2019 | WK 10/19, 2019 | 4.1 % | 4.3 % | ||

| Existing Home Sales | 10/22/2019 | Sept 2019 | 5.490 M | 5.50 M | 5.440 M | 5.380 M |

| Richmond Fed Mfg. Index | 10/22/2019 | October 2019 | -9 | -9 | 8 | |

| MBA Mortgage Applications W/W Change | 10/23/2019 | WK 10/18, 2019 | 0.5 % | -11.9 % | ||

| FHFA Housing Price Index M/M Change | 10/23/2019 | August 2019 | 0.4 % | 0.4 % | 0.2 % | |

| Durable Goods Order M/M Change | 10/24/2019 | Sept 2019 | 0.2 % | 0.3 % | -0.7 % | -1.1 % |

| Jobless New Claims | 10/24/2019 | WK 10/19, 2019 | 214 K | 218 K | 214 K | 212 K |

| New Home Sales | 10/24/2019 | Sept 2019 | 713 K | 706 K | 698 K | 701 K |

| Kansas City Fed Mfg. Index | 10/24/2019 | October 2019 | -2 | -3 | ||

| FED Balance Sheet | 10/24/2019 | WK 10/23, 2019 | $3.966 T | $3.969 T | ||

| Money Supply M2 Weekly Change | 10/24/2019 | WK 10/14, 2019 | $39.2 B | $41.1 B | $15.2 B | |

| Consumer Sentiment | 10/25/2019 | Oct.(r) 2019 | 96 | 96 | 95.5 | |

| Baker-Hughes Rig Count | 10/25/2019 | WK 10/25, 2019 | 994 | 977 | ||

| Treasury Budget level | 10/25/2019 | Sept 2019 | $-200.3 B | $106 B | $82.2 B |

This week’s major events:

| Monday | International Trade in Goods; Chicago Fed National Activities; Dallas Fed Mfg. Index; Retail Inventories; Wholesale Inventories | ||

| Tuesday | FOMC Meeting; Redbook; S&P Core-logic Case Shiller HPI; Consumer confidence; Pending Home sales | ||

| Wednesday | GDP; ADP Employment Report; MBA Mortgage Applications; State Street Investor Confidence; FOMC Meeting Announcement; FED CHAIR Press Conference | ||

| Thursday | Chicago PMI; FED Balance sheet; Money Supply | ||

| Friday | Employment Situation; PMI Mfg. Index.; ISM Mfg. Index; Construction spending; Baker-Hughes Rig count |

Economy:

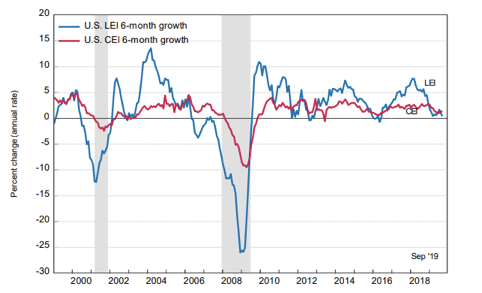

Economic news was indicating Mfg. sector lagging. Retail is holding well. Housing market is slow. Lat week Leading economic indicators (LEI) were down but not critical level of below ‘0’ to indicate recession. This indicator has a great track record for predicting recessions. Need to keep close eye on this.

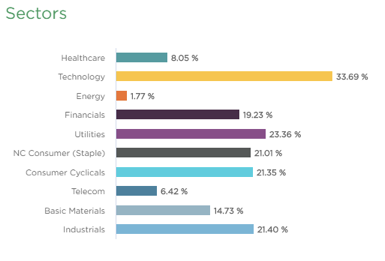

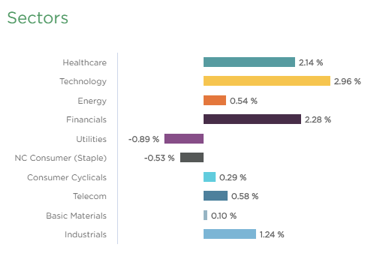

Sector performance:

Stock to Watch: None

Strongest groups are Mining-Gold/Silver, Insurance, Commercial services, Aerospace/Defense, Building Construction, Telecom

Weakest groups are Oil and Gas, Retail-Mall, Tobacco, Steel Producers, Food

Watch List: Our strong RS/Growth screen is showing following candidates.

CMG, PAGS, PCTY, TEAM, RNG, EPAM, FIVN, LULU, SEDG, NOC, IPHI, COST, CPRT, ESNT, KEYS, RDN

Summary:

All-clear signal is still missing for investors. Be cautious but get ready with your list of stocks with strong fundamentals and high relative strength to act upon.