Market rally is hitting resistance zone here. This week is Crucial for markets. Tuesday and Wednesday FED is meeting and G20 meeting follows right after that. Will FED be proactive for possible escalating trade war with China? President Trump is expected to meet Chinese Premier during G20 meeting. Market will be watching.

Markets remain news driven. NASDAQ need to overcome resistance level of 7950 on greater volume in coming days for us to believe in this rally. VIX needs to close below 14.40 level.

The market is in Uptrend.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| JOLTS Jobs Openings | 6/10/2019 | April 19 | 7.488M | 7.474M | 7.400M | 7.449M |

| Small Business Optimism Index | 6/11/2019 | May 2019 | 103.5 | 102.0 | 105.00 | |

| PPI FD M/M Change | 6/11/2019 | May 2019 | 0.2% | 0.1% | 0.1% | |

| Redbook Store Sales Y/Y Change | 6/11/2019 | WK 6/8, 2019 | 5.8% | 5.0% | ||

| MBA Mortgage Applications W/W Change | 6/12/2019 | WK 6/07, 2019 | 1.5% | 26.8% | ||

| CPI M/M Change | 6/12/2019 | May 19 | 0.3% | 0.1% | 0.1% | |

| Atlanta Fed Business Infl. Expectations % Yr/Yr | 6/12/2019 | June 2019 | 2.0% | 2.0% | ||

| Treasury Budget level | 6/12/2019 | May 2019 | $160.3B | -$198.0B | -207.8B | |

| Jobless New Claims | 6/13/2019 | WK 6/8, 2019 | 218K | 219K | 216K | 222K |

| Import Prices M/M Change | 6/13/2019 | May 2019 | 0.2% | 0.1% | -0.3% | -0.3% |

| Export Prices M/M Change | 6/13/2019 | May2019 | 0.2% | 0.1% | 0.1% | -0.2% |

| FED Balance Sheet | 6/13/2019 | WK 6/12, 2019 | $3.851T | $3.848T | ||

| Money Supply Weekly Change | 6/13/2019 | WK 6/3, 2019 | $56.6B | $47.8B | $28.4B | |

| Retail Sales | 6/14/2019 | May 2019 | -0.2% | 0.3% | 0.7% | 0.5% |

| Industrial Production M/M Change | 6/14/2019 | May 2019 | -0.5% | -0.4% | 0.2% | 0.4% |

| Manufacturing M/M Change | 6/14/2019 | May 2019 | -0.5% | 0.2% | 0.2% | |

| Business Inventories M/M Change | 6/14/2019 | April 19 | 0.0% | 0.5% | 0.5% | |

| Consumer Sentiment | 6/14/2019 | June 2019 | 100 | 98.4 | 97.9 | |

| Baker-Hughes Rig Count | 6/14/2019 | WK 6/14, 2019 | 1078 | 1076 |

This week’s major events:

| Monday | Empire State Mfg. Survey; Housing Market Index; Treasury International Capital | |

| Tuesday | FOMC Meeting; Housing Starts; Redbook | |

| Wednesday | MBA Mortgage Applications; FOMC Meeting Announcement; FED Chair Press Conference | |

| Thursday | Jobless Claims; Philly Fed Business Outlook; Current Account; Leading Indicators; FED Balance Sheet; Money supply | |

| Friday | PMI Composite Flash; Existing Home Sales; Baker Hughes Rig Count |

Economy:

Retail sales are showing strength and inflation is well below target. Business inventories rise. All eyes on FED this week. Does it act believing strong economic picture or anticipates effects of escalating Chinese Trade war this week?

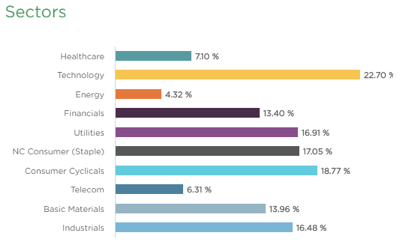

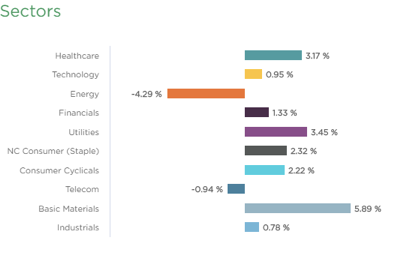

Sector performance:

Stock to Watch:

Let us watch for high RS stocks for now but hold on buying into new positions until signs of institutional demand returning into market.

Strongest groups are Software, Insurance, Business service, Insurance, Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Retail; Food, Energy, Media; Medical

Watch List: Our strong RS/Growth screen is showing following candidates.

TEAM, CHGG, PYPL, CYBR, FIVN, CASY, LLY, LULU, NOW, HUBS, FIVE, ADBE, ADSK, MSFT, HEIA, TWLO, WDAY, ETSY, EPAM, MTCH, LPLA, GDDY; AMZN, PAGS, FB, FNKO, BAH, CPRT, ENTH, HEI, LLL, PAYC, PGR, PODD, VEEV, VRSN, KL, GNRC, CACC, AMD, MDSO

Summary:

Experiencing resistance here. Look out for strong RS stocks in this correction for future leadership to emerge.