Market tested 200DMA resistance last week. Be watchful for nature of consolidation this week or two. The market is in confirmed rally. Breakouts are improving a bit. Right side of the base chart patterns are still work in progress. Volatility index VIX is in narrow range for past three weeks. Resistance at 22 and support at 16. Market’s near-term direction will be decided which levels breaks first. On Friday, Mr. President and Democrats agreed to lift Govt shutdown for three weeks, till Feb 15,2019. This means no resolution yet on policy disagreement. China is continuing to stimulate its economy gradually.

Recap of last week:

China Trade War Escalation Risk Fades: China Trade talks have hit a snag over intellectual-property protections last week. Chinese and American officials are trying to strike a China trade deal that would avert escalation of Trump tariffs from 10% to 25% on $200 billion in Chinese imports starting March 2. Even with the latest snag in the talks, China trade escalation now looks very unlikely. The two countries are setting up the next round of high-level talks for the end of this month. With China economy slowing and Trump seeking to fix December market ‘glitch’ attributed to trade wars, neither side can afford to walk away from the table.

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Existing Home Sales | 1/22/2019 | Dec-18 | 5.320M | 5.330M | 5.225M | 4.990M |

| Existing Home Sales M/M Change | 1/22/2019 | Dec-18 | 1.9% | 2.1% | -6.4% | |

| MBA Mortgage Applications W/W change | 1/23/2019 | Wk 1/18 | 13.5% | -2.7% | ||

| Redbook Store Sales Y/Y Change | 1/23/2019 | Wk 1/18 | 6.7% | 7.0% | ||

| FHFA House Price Index M/M Change | 1/23/2019 | Nov-18 | 0.3% | 0.4% | 0.3% | 0.4% |

| Richmond FED Mfg Index | 1/23/2019 | Jan-19 | -8 | -3 | -2 | |

| Jobless Claims -New | 1/24/2019 | Wk 1/19 | 213K | 212K | 218K | 199K |

| Leading Indicators M/M Change | 1/24/2019 | Dec-18 | 0.2 | -0.1 | -0.1 | |

| Durable Goods Orders M/M Change | 1/25/2019 | Dec-18 | 0.8% | 1.8% | ||

| New Home Sales | 1/25/2019 | Dec-18 | 569K% |

Housing market data is continuing down trend. Employment report shows strength.

This week’s major events:

| Monday | Chicago Fed National Activity Index; Dallas Fed Mfg Survey |

| Tuesday | FOMC Meeting; International Trade; Retail Inventories; Wholesale Inventories; Case Shiller HPI; Consumer Confidence |

| Wednesday | ADP Employment Report; GDP; Pending Home Sales Index; FOMC Meeting Announcement & Press Conference |

| Thursday | Challenger Job-Cut Report; Jobless Claims; Personal Income and Outlays; Employment Cost Index; Chicago PMI |

| Friday | Employment Situation; PMI Mfg Index; ISM Mfg Index; Construction Spending; Consumer Sentiment |

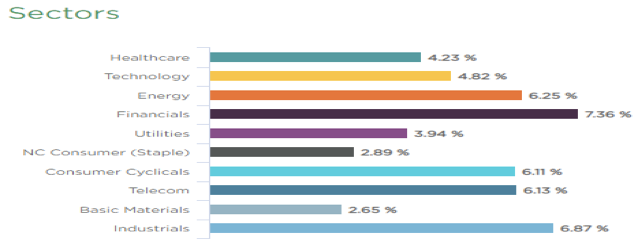

Sector performance YTD ending January 25, 2019:

Stock to Watch: CYBR (CyberArk Software)

This week we highlight CyberArk Software. Israeli based security company has a solid annual growth rate of 43%. Its Gross Margins are 85%. Net Margins have expanded steadily from 18% to 21%. In past four quarters, EPS has impressive turn around (0%, 14%, 71%, 92%) with Sales (24%-22%-35%-30%). Next Qtr EPS est is 44%. Institutional ownership has steadily gone up in last four quarters from 144 to 249. Few quality institutions, such as, Columbia Acorn (ACRNX), Wasatch Micro Cap (WMICX) are also owning this company adding confidence to our selection.

In recent market correction, stock had held up well with only 23% correction and Relative Strength of 97. Stock is setting up to buy above $84.35

Strongest groups are Telecom, Computer software-enterprise, Auto Parts

Weakest groups are Oil& Gas Exploration & production, Transportation & Steel.

Watch List: Our strong RS/Growth screen is showing few candidates.

TEAM, CHGG, FN, PYPL, QNST, CYBR, BEAT, VRTX, FIVN, CASY, LLY, LULU

Summary:

Markets are seeing some consolidation here. This would be healthy for developing some leadership in days ahead. Nature of consolidation is important and must hold 50DMA on the indices. Let us watch the nature of this consolidation before adding exposure here.