Trade war escalates. Yearlong discussions on trade issues with China bear no fruit. Negotiations continue but on Friday President Trump increased tariffs on Chinese goods from 10% to 25% and plans on adding more goods for tariffs. Chinese have promised to retaliate. Chinese have backed off from initial agreements on IP protections. US feels, with strong economy, we are in better position to deal with decades old trade issues with China. Historically, trade wars have no winners. But US believes that ignoring these issues is to continue to reward a bad behavior. No doubt, markets are reacting and have broken important support this morning. How deep this correction will be? It depends, President Trump is risking his 2020 reelection and have more to lose vs Chinese premier (protected by communist system). There is still time to save the deal in next two months.

Markets broke major support levels at 50DMA on Monday morning.

The market is now in ‘Down Trend’. Protecting capital should be the goal in this news driven environment.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Redbook Store Sales Y/Y Change | 5/7/2019 | WK 5/04, 2019 | 5.5% | 5.9% | ||

| JOLTS Jobs Openings | 5/7/2019 | March 19 | 7.087M | 7142M | 7.215M | 7.488M |

| Consumer Credit | 5/7/2019 | March 19 | $15.2B | $15.5B | $16.5B | $10.3B |

| MBA Mortgage Applications W/W Change | 5/8/2019 | WK 5/03, 2019 | -4.3% | 2.7% | ||

| Trade Balance | 5/9/2019 | March 19 | $-49.4B | $-49.3B | $-50.2B | $-50.0B |

| Jobless New Claims | 5/9/2019 | WK 5/04, 2019 | 230K | 215K | 228K | |

| PPI FD M/M Change | 5/9/2019 | April 19 | 0.6% | 0.3% | 0.2% | |

| US Wholesale Trade Inventories M/M Change | 5/9/2019 | March 19 | 0.2% | 0.4% | -0.1% | |

| FED Balance Sheet | 5/9/2019 | WK 5/08, 2019 | $3.890T | $3.892T | ||

| Money Supply Weekly Change | 5/9/2019 | WK4/29, 2019 | $-22.9B | $-22.8B | $51.6B | |

| CPI M/M Change | 5/10/2019 | April 19 | 0.4% | 0.4% | 0.3% | |

| Baker-Hughes Rig Count | 5/10/2019 | Wk 5/10; 2019 | 1051 | 1051 |

This week’s major events:

| Monday | |

| Tuesday | Small Business Optimism Index; Redbook; Import and Export Prices |

| Wednesday | MBA Mortgage Applications; Retail Sales; Empire State Mfg Survey; Industrial Production; Business Inventories; Housing Market Index |

| Thursday | Housing Starts; Jobless Claims; Philadelphia Fed Business Outlook Survey; Fed Balance Sheet; Money Supply |

| Friday | Consumer Sentiment; E-Commerce Retail Sales; Leading Indicators; Baker-Hughes Rig count |

Economy:

Consumer prices in the US grew by 0.3% last month and 2% on a 12 month basis. No news here. Inflation staying very low. Globally, there was no market moving data released last week.

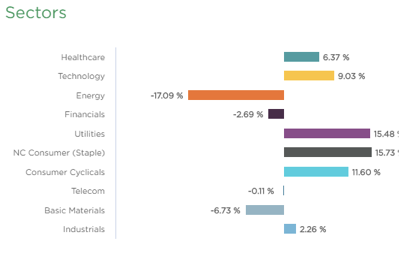

Sector performance YTD performance ending May 10, 2019:

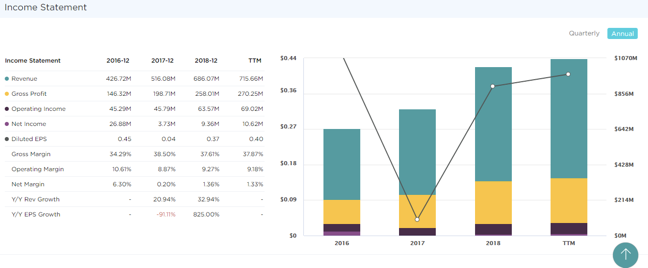

Stock to Watch: Funko Inc (FNKO)

Funko designs, manufacture and distributes licensed culture products.

The Facebook has been growing 41% annually. Last few quarters sales growth has been 24%; 38%; 22% with EPS growth of 108%; 110%; 433%. Annual EPS in 2015 of $0.25 has grown to $0.82 in 2018. Estimated EPS growth for next two years is 40%. Gross margins have been maintained in % and ROE of 29%. Management owns 18% of shares outstanding.

Strongest groups are Energy, Chips, Software, Finance, Business service, Insurance, Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Retail; Media; Medical; Food.

Watch List: Our strong RS/Growth screen is showing following candidates. List is expanding this week. TEAM, CHGG, FN, PYPL, CYBR, BEAT, VRTX, FIVN, CASY, LLY, LULU, NOW, SAVE, HUBS, BA, FIVE, ADBE, INCY, ABMD, PANW, ADSK, MSFT, HEIA, UBNT, TWLO, TTD, WDAY, ETSY, EPAM, ANET, MTCH, LPLA, FTNT, GDDY; AMZN, PAGS, ATHM, TWLO, BZUN, ALXN, FB, FNKO

Summary:

Markets reacting on trade deal failure with China and have broken important support at 50DMA. We expect 200DMA support to hold for now. Protecting our capital is important in this news driven environment. Reduce exposure and exit positions with marginal profits or any losses.