Markets have turned lower after making new highs last week. Wednesday was poor day for markets in recent weeks. NASDAQ declined over 1% on higher volume and many leaders were hit hard. SPX have declined back into earlier range. Other world markets had rallied last week and were showing hope of settled waters. But they could only rally to resistance levels and have since declined on higher volume. There are many concerns on many fronts. As we have pointed out in last commentaries be on lookout for confirmation either on upside or downside to indicate ‘trade war’ is getting resolved. Internals need to improve. There are few pockets showing positive action.

Recap of last week:

Unfortunately, there were no breakthroughs on trade talks with China. These have been volatile with no certain outcome yet. Hopefully, breakthrough may be declared before midterm elections.

Trade talks with CANADA broke down last week. Both sides have agreed to meet again.

Foreign markets including CHINA are showing weakness and may be ready to test August lows in days ahead. Foreign currencies (Turkish Lira & Argentina Peso) are under duress. Argentina has rates to 60% to protect capital flight & in discussion with IMF.

This week’s major events:

- ADP employment report is coming Thursday. Economists are expecting 182,000

- Non-farm productivity is expected to improve Q/Q by +3% but Labor costs are expected to decline by 1% Q/Q

- Factory orders are expected to decline 0.7%

- On Friday we get Employment situation reports. Unemployment rate is expected to be 3.8% and Private Payrolls change M/M is expected at 190,000

Valuation: Current S&P valuations are approaching 2000 levels. Price/Sales ratio is currently at 2.4 level and above pre-2000 level of 2.35.

Wilshire 5000 Market Cap to GDP ratio is also at record all time high of 145 and above pre-2000 level of 140.

Be on look out for top in early 2019 and major recession lasting till 2022-23. Internals (breadth and supply/demand divergence) have historically given us early warning signs of top which are absent currently.

Strongest groups are 1) Retail 2) Medical-software 3) Medical- products 4) Medical-Hospitals 5) Enterprise-Software

Weakest groups are 1) Steel 2) Machinery 3) Building (residential, Commercial) 4) Solar -energy 5) Chemical

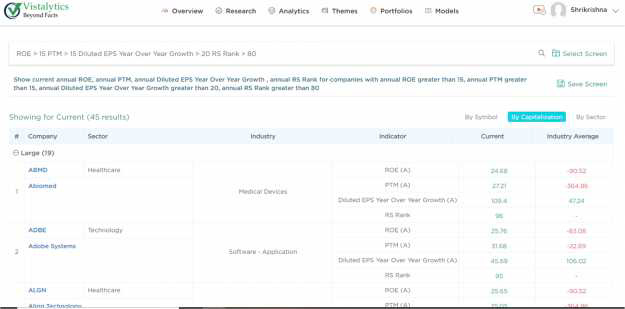

Above list was generated with the help of Vistalytics ‘EDGE” platform.

Check out the sector performance for last three months in following illustration.

Chart 1. 3M performance of Sectors. Courtesy Vistalitics.COM

Vistalytics ‘EDGE’ platform is user friendly for implementing your favorite ‘search’ routines to discover the nuggets in the market. I am sharing one of my favorite ‘screen’ which exhibited current leaders in the market with sound fundamentals.