Since reversal from resistance levels at 50DMA & 200DMA market has shown little interest to rally. This week’s FED’s interest rate hike with strong US economy (New Jobless claims came in way below consensus) is being discounted by markets. This morning, indexes are breaking October lows near 7000 on NASDAQ & 2600 on S&P. Volatility has been indicating last few weeks of this possibility. Now, let us look for spike above 30 in VIX to see short-term lows in near here. World markets are testing prior lows here. If they break these levels would be another indication that correction will be deeper.

Recap of last week:

US Tariffs: China has kept moving forward with the commitment made between Trump and Xi on Saturday’s meeting in Argentina. Chinese Minister of Commerce said Beijing will implement agreements on agriculture, energy and cars. Tariffs on auto have come down from 40% to 15%. Beijing has also removed tariffs on Soybeans. US has also made concessions with China. It’s more likely that there will be China deal.

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| PMI FD M/M Change | 12/11/2018 | Nov-18 | 0.60% | 0.00% | 0.10% | |

| PMI FD Y/Y Change | 12/11/2018 | Nov-18 | 2.90% | 2.50% | ||

| CPI M/M Change | 12/12/2018 | Nov-18 | 0.30% | 0.00% | 0.00% | |

| CPI Y/Y Change | 12/12/2018 | Nov-18 | 2.50% | 2.20% | 2.20% | |

| Jobless Claims (New) | 12/13/2018 | Wk 1208 | 231K | 233K | 228K | 206K |

| Import Prices M/M change | 12/13/2018 | Nov-18 | 0.05% | -1.0% | -1.6% | |

| Export Prices M/M change | 12/13/2018 | Nov-18 | 0.4% | 0.5% | 0.1% | -0.9% |

| Retail Sales M/M change | 12/14/2018 | Nov-18 | 0.8% | 1.1% | 0.1% | 0.2% |

| Industrial Production M/M change | 12/14/2018 | Nov-18 | 0.1% | -0.2% | 0.3% | 0.6% |

| Manufacturing M/M change | 12/14/2018 | Nov-18 | 0.3% | -0.1% | 0.2% | 0.0% |

| Capacity Utilization | 12/14/2018 | Nov-18 | 78.40% | 78.10% | 78,5% | 78.50% |

| Business Inventories | 12/14/2018 | Oct-18 | 0.3% | 0.5% | 0.6% | 0.6% |

Jobless claims came is at 206,000. This was way below consensus number of 228,000. Clear indication of strong US economy. This will prompt FED to hike rates this week.

This week’s major events:

| Monday | Empire State Mfg Survey; Housing Market Index |

| Tuesday | Housing Starts; FOMC Meeting Starts |

| Wednesday | Existing Home Sales; FOMC Meeting Announcement; FED Chair Press Conference |

| Thursday | Jobless Claims; Leading Indicators; Phil FED Survey |

| Friday | Durable Goods Orders; GDP; Personal Income; Consumer Sentiment |

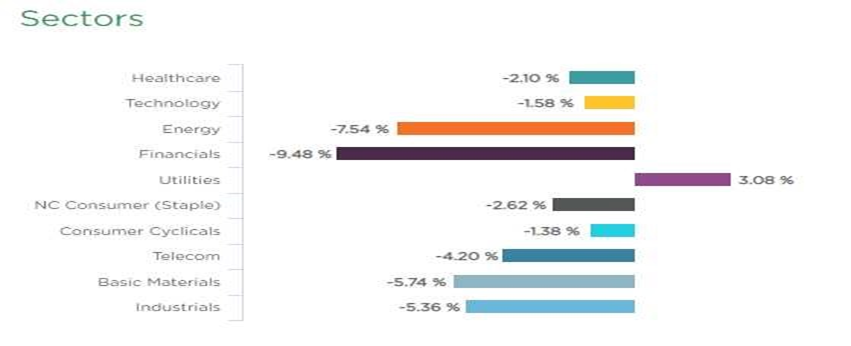

Sector performance in last 1 month ending December 14, 2018:

Chart 1. One Month performance of Sectors. Courtesy www.Vistalytics.COM

Chart 1 above shows that all sectors are down last month except Utilities while major indexes are breaking October lows here.

Strongest groups are Utilities, Auto Parts & Healthcare (Medical-Outpatient)

Weakest groups are Basic Materials, Energy & Steel.

Watch List: Our strong RS/Growth screen narrowed lists of potential candidates to put on “Watch list” Some of them are AMED, BEAT, PRAH, VEEV

Summary: Markets are breaking October lows and possibly extending into ‘Bear’ territory. This is not the time to buy. It will be like catching a falling knife. Protect your capital for future opportunities. In Bear environment, no stocks are safe to own.