Trade war escalates. Complacency from President and FED policymakers about the strength of the U.S. economy and its ability to withstand a China trade war set for a brutal fourth quarter of 2018. The bad news is that complacency is once again running high. Trump is tightening the screws on China. He thinks the U.S. economy will keep chugging in the face of escalating trade-war tariffs or else China will fold. Both assumptions may not be right. The FED policymakers are in wait-and-see mode on whether the trade war will take a toll on the economy. FED is again being reactive. Retail sales dipped in April after a March sales surge aided by bigger refundable child tax credits. New tariffs will hold back business investment. If global growth and financial markets take a hit, U.S. economy growth likely will surprise on the downside.

The revival of a bull market in December had three factors. A dovish FED, a China trade deal, and Chinese economic stimulus. These would provide growth in global economy and remove key risks to corporate profits. Now, all three factors are in doubt. The price of copper, Dr. in economics, slumped on Monday close to two-year low. Both sides are digging in their heels. Dive in markets may awaken them to reality and at least call for cease-file before 25% tariffs take into effect.

Markets rallied for three days after braking major support levels at 50DMA but once again below that level on Monday morning.

The market is in ‘Down Trend’. Protecting capital should be the goal in this news driven environment.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Small Business Optimism Index | 5/14/2019 | April 19 | 101.8 | 102.4 | 103.5 | |

| Import Prices M/M Change | 5/14/2019 | April 19 | 0.6% | 0.7% | 0.2% | |

| Export Prices M/M Change | 5/14/2019 | April 19 | 0.7% | 0.6% | 0.5% | 0.2% |

| Redbook Store Sales Y/Y Change | 5/14/2019 | WK 5/11, 2019 | 5.9% | 5.4% | ||

| MBA Mortgage Applications W/W Change | 5/15/2019 | WK 5/10, 2019 | 2.7% | -0.6% | ||

| Empire State Mfg- Business Conditions | 5/15/2019 | May 19 | 10.1 | 9.0 | 17.8 | |

| Industrial Production M/M Change | 5/15/2019 | April 19 | -0.1% | 0.2% | 0.0% | -0.5% |

| Manufacturing M/M Change | 5/15/2019 | April 19 | 0.0% | 0.1% | -0.5% | |

| Business Inventories M/M Change | 5/15/2019 | Feb 19 | 0.3% | 0.1% | 0.0% | |

| Housing Market Index | 5/15/2019 | May 2019 | 63 | 64 | 66 | |

| US Housing Starts | 5/16/2019 | April 19 | 1.139M | 1.368M | 1.20M | 1.235M |

| Jobless New Claims | 5/16/2019 | WK 5/11, 2019 | 228K | 219K | 212K | |

| Philadelphia FED Business Outlook | 5/16/2019 | May 2019 | 8.5 | 9.3 | 16.6 | |

| FED Balance Sheet | 5/16/2019 | WK 5/15, 2019 | $3.892T | $3.865T | ||

| Money Supply Weekly Change | 5/16/2019 | WK4/29, 2019 | $51.6B | $52.6B | $10.6B | |

| Consumer Sentiment | 5/17/2019 | May 19 | 97.2 | 97.5 | 102.4 | |

| E-Sales Q/Q Change | 5/17/2019 | Q1:2019 | 2.0% | 3.6% | ||

| Leading Indicators | 5/17/2019 | April 19 | 0.4% | 0.3% | 0.3% | 0.2% |

| Baker-Hughes Rig Count | 5/17/2019 | Wk 5/17, 2019 | 1051 | 1050 |

This week’s major events:

| Monday | Chicago FED Survey | ||

| Tuesday | Redbook; Existing Home Sales | ||

| Wednesday | MBA Mortgage Applications; FOMC minutes | ||

| Thursday | Jobless Claims; PMI Composite; New Home Sales; Kansas City FED mfg Index; Fed Balance Sheet; Money Supply | ||

| Friday | Durable Goods Orders; Baker-Hughes Rig count |

Economy:

Consumer prices in the US grew by 0.3% last month and 2% on a 12 month basis. No news here. Inflation staying very low. Globally, there was no market moving data released last week.

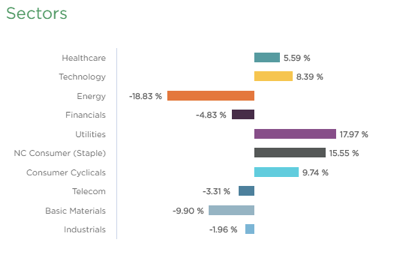

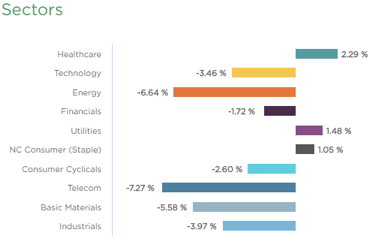

Sector performance YTD performance ending May 10, 2019:

Stock to Watch:

Let us watch for high RS stocks for now but hold on buying into new positions.

Strongest groups are Software, Finance, Energy, Chips, Business service, Insurance, Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Retail; Media; Medical

Watch List: Our strong RS/Growth screen is showing following candidates. TEAM, CHGG, FN, PYPL, CYBR, BEAT, VRTX, FIVN, CASY, LLY, LULU, NOW, SAVE, HUBS, FIVE, ADBE, INCY, ABMD, PANW, ADSK, MSFT, HEIA, UBNT, TWLO, WDAY, ETSY, EPAM, MTCH, LPLA, FTNT, GDDY; AMZN, PAGS, ATHM, BZUN, ALXN, FB, FNKO

Summary:

Markets have broken important support at 50DMA and are in correction. We expect 200DMA support to hold for now. Reduce exposure and exit positions with marginal profits or any losses. Look out for strong RS stocks in this upcoming correction.