After overcoming resistance zone for NASDAQ & SPX on higher volume, market wants to take a breather. Market is concerned about trade deal with China. Mr. President may be losing opportunity to get the best deal. Chinese economy is improving and Chinese may not have the incentives to give everything Mr. Trump wants. If the tariff war continues, global economy may suffer. BREXIT has been postponed till May 22. Muller report came out with no damage to Presidency for now. The market is under pressure. Our models are positive for intermediate & long trend. Stay focused on strong holdings and opportunity to add to them.

Recap of last week:

Economic Reports:

| Economy Indicator | Released Date | Period | Prior | Prior Revised | Consensus | Actual |

| Housing Market Index | 3/18/2019 | March 19 | 62 | 63 | 62 | |

| Store Sales Y/Y Change | 3/19/2019 | Wk3/16, 2019 | 4.4% | 4.9% | ||

| Factory Orders | 3/19/2019 | Jan 19 | 0.1% | 0.0 | 0.1% | |

| Mortgage Applications W/W change | 3/20/2019 | WK 3/16, 2019 | 2.3% | 1.6% | ||

| Jobless Claims -New | 3/21/2019 | Wk3/16, 2019 | 229K | 230K | 225K | 221K |

| Philadelphia Fed Business Conditions | 3/21/2019 | March 19 | -4.1 | 5.5 | 13.7 | |

| Leading Indicators M/M Change | 3/21/2019 | Feb 19 | -0.1% | 0.0% | 0.1% | 0.2% |

| PMI Composite | 3/22/2019 | March 19 | 55.8 | 55.2 | 54.3 | |

| Existing Home Sales | 3/22/2019 | Feb 19 | 621K | 652K | 612K | 607K |

| Wholesale Trade | 3/22/2019 | Jan 19 | 1.1% | 0.1% | 1.2% | |

| Baker-Hughes Rig Count | 3/22/2019 | Wk 3/22 2019 | 1187 | 1121 |

This week’s major events:

| Monday | Chicago Fed National Activity; Dallas Fed Mfg Survey |

| Tuesday | Redbook; Consumer Confidence; Shiller HPI; Richmond Fed Mfg Survey |

| Wednesday | International Trade; Retail Inventories; Wholesale Inventories |

| Thursday | GDP; Jobless Claims; Pending Home Sales; Kansas Fed Mfg Index |

| Friday | Personal Income & Outlays; Chicago PMI; New Home Sales; Consumer Sentiment; Baker Hughes Rig Count |

Economy:

FOMC left interest rates unchanged and sounded dovish on monetary policy, Unfortunately, it had no effect on market. Housing market is still slowing down.

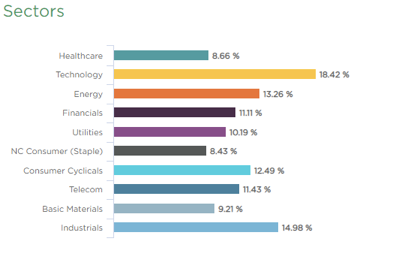

Sector performance YTD ending March 22, 2019:

Stock to Watch:

We will not review any stock today. We will wait to see how this correction develops and which stocks show relative strength.

Strongest groups are Energy, Software, Finance, Medical, Insurance, Mining, Computer-Tech services, Computer Software-enterprise, Computer Software-Database, Telecom, Computer Software-Security.

Weakest groups are Transport; Retail; Food.

Watch List: Our strong RS/Growth screen is showing following candidates. List is expanding this week.

TEAM, CHGG, FN, PYPL, CYBR, BEAT, VRTX, FIVN, CASY, LLY, LULU, NOW, SAVE, HUBS, BA, FIVE, ADBE, INCY, ABMD, PANW, SSNC, ADBE, ADSK, MSFT, HEIA, UBNT, TWLO, TTD, WDAY, ETSY, EPAM, LPLA, FTNT, GDDY.

Summary: Markets will be testing support levels at 200DMA. Let us watch which stocks perform best on relative basis from the list of strong stocks. Next week or so may provide opportunity to add at proper support levels.